When you’re shopping for a new car, you might have to fill out applications and wait weeks or even months for a response. It’s not that different when it comes to applying for credit – there are just so many options and lenders out there, making it hard to find the right one. But don’t worry! In this article, we’ll show you how to apply for a credit online and get approved in no time at all.

What is a Credit Application?

Credit applications are a way to get approved for a loan or credit card. When you apply for a credit, you are submitting an application to a lending institution. Your application will include your personal information and financial information. The lending institution will review your application and decide whether or not to approve it. If you are approved for a credit, the lending institution will give you a loan or credit card.

How to Apply for a Credit Online?

If you are looking to improve your credit score and get approved for a new loan, you can do so through online credit applications. There are a number of different websites that allow you to apply for a loan, Credit Karma being one of the most popular. Here are five tips for applying for a credit online:

- Use a reliable credit monitoring service. Credit scoring models use data from both your current and past credit reports. By using a reputable credit monitoring service, you can ensure that your current report is accurate and that any errors from your past have been corrected.

- Verify your personal information. Before filling out any online forms, make sure all the information on the form is correct, including your name, address, and Social Security number. Any errors could lead to delays in getting your application processed or an outright rejection.

- Keep track of your application status. When you submit an online application, be sure to keep track of the application’s progress and update your contact information if necessary. You may need to contact the creditor if there are any changes in your financial situation or if there are any problems with the application process.

- Pay attention to interest rates and terms. Always compare interest rates and terms before submitting an application. Be sure to read the entire loan agreement, including the fees and penalties associated with late payments.

- Consider using a credit builder product. Many lenders offer credit builder products that allow you to build your credit history over time by submitting small debts and payments on time. This can help you improve your credit score and get approved for a new loan more quickly.

What To Expect When Applying For a Credit Online?

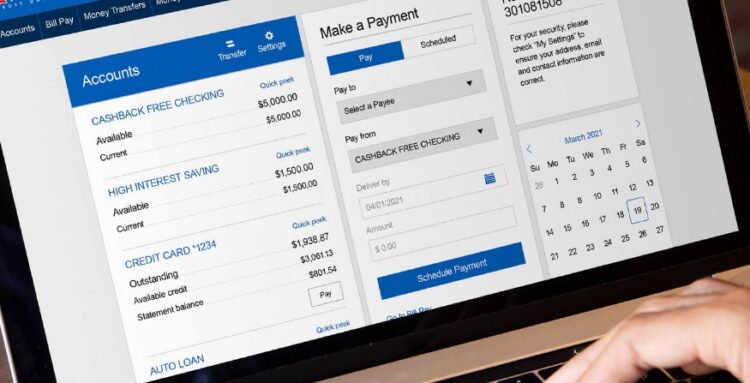

When you’re ready to apply for a credit online, there are a few things to expect. The first thing is to gather all of the necessary information. This includes your name, address, Social Security number, and date of birth. You’ll also need to provide your current credit report and bank statements.

Once you have all of the necessary information, you’ll need to create an account with the credit bureau or lender that you want to apply with. This will allow you to input all of your information in one place.

The next step is to complete the application form. This will require you to provide your updated information and any supporting documents. When you’re finished, you’ll need to submit the form along with payment information.

If you’re approved for a credit online, congratulations! You’ll now be able to access your new credit score and credit limit online.

Applying for a Credit Online: The Process

If you’re looking to apply for a credit online, there are a few things you need to know before getting started. First, you’ll need to determine your eligibility. This means reviewing your credit history and credit score to see if you’re likely to be approved for a loan. Next, you’ll need to create an online application. This will require you to provide your personal information, including your Social Security number and income information. Once you’ve completed the application process, you’ll need to wait for a response from the lender. Depending on your credit score and other factors, it could take up to two weeks for a decision to be made. If you’re approved for a loan, the lender will send you a loan contract and closing instructions.

What To Do If You’re Approved for Credit?

If you’re approved for a credit online, congratulations! But there are still a few things you need to do before you can start using the credit. Here’s what to do:

- Get your credit report. Your credit report is a compilation of your credit history, which is information about your past borrowing and lending activities. You’ll need to get your free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once each year. To make sure you get all three reports, call them all and ask for one “free copy of my credit report.”

- Update your credit file. Once you have your reports, it’s time to update your file with the appropriate bureau. This will ensure that any new information in your reports is reflected in the files with the appropriate bureau. There are two ways to do this: You can either pull up a form from each bureau and fill it out online, or you can call each bureau and have them mail you a form to complete and return.

- Check your Credit utilization ratio (CU). This is an important number that lenders use when considering whether to approve you for new credit. The CU tells them how much of your available credit you’re using each month. The lower the CU, the better.

- Check your credit score. Your credit score is a number that reflects your creditworthiness and is used by lenders to make decisions about whether to lend you money or approve you for a credit card. You can get your free credit score from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once each year. To make sure you get all three reports, call them all and ask for one “free copy of my credit report.”

- Make sure all your information is accurate. Once you have updated your files and scored, it’s time to make sure everything is accurate. This includes things like your name, address, Social Security number, and other important information. If there are any changes in any of this information, please update it as soon as possible so that it’s reflected in all three files.

Conclusion

We hope that this article has helped you learn a little bit about how to apply for a credit online and get approved. We have outlined the steps that you need to take in order to get started, and we’ve provided helpful tips along the way. If you follow these simple steps, you will be successful in getting approved for a credit online. So, what are you waiting for? Start applying today!