Whenever one has a steady income, there is a lot of expectation related to how to spend it. One would have to understand the limitations until which they can spend because savings matter a lot too. Everyone knows what their basic necessities are and how much one is going to spend on it. But when it comes to things you want, the line between saving and spending can blur a lot.

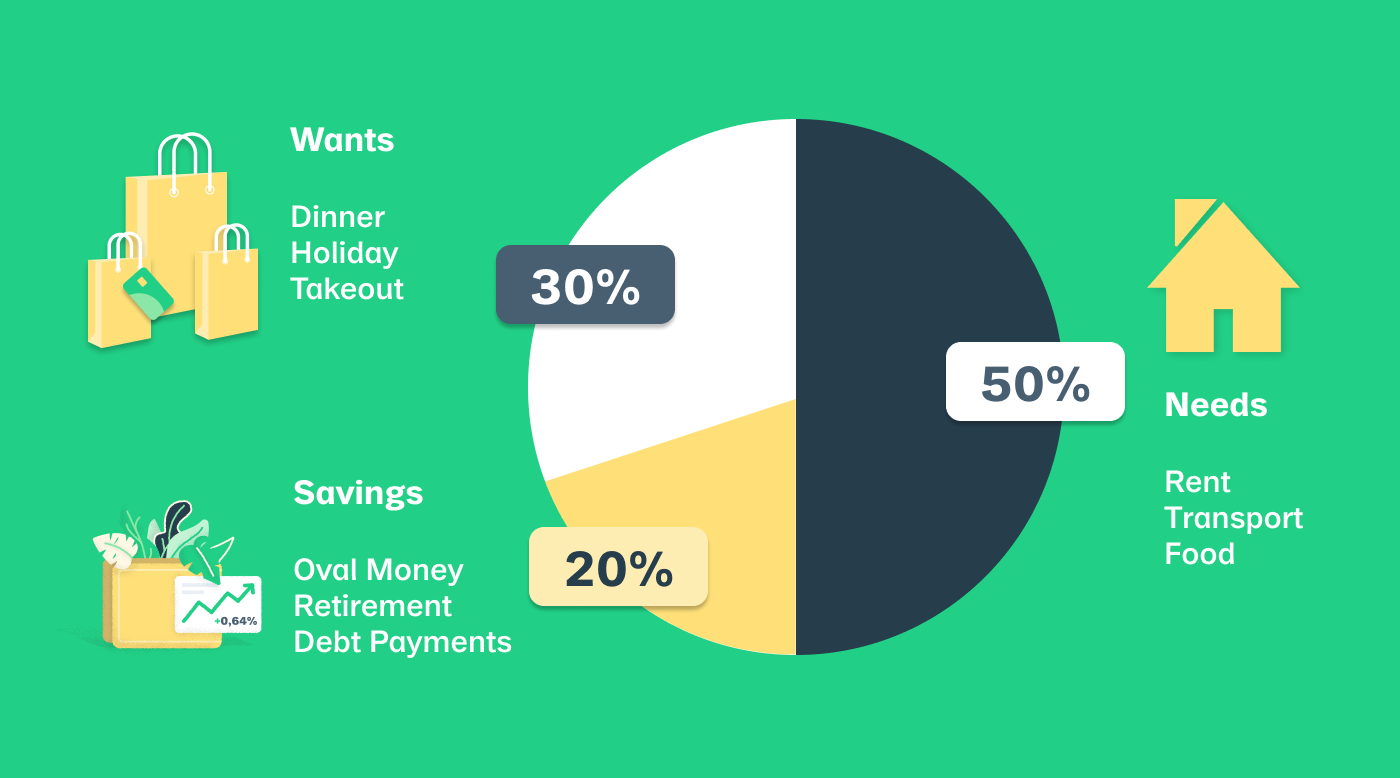

This is why budgeting is important. However, simple budgeting can still be limited which is why you require a targeted saving plan which allocates certain wants and needs while taking care of savings to be used in case of emergencies. One such rule is the 50/30/20 saving rule. Let us try to understand its importance in budgeting.

What is The 50/20/30 Saving Rule?

The 50/20/30 saving rule is made for easy budgeting for all incomes that come into the bank account after tax deductions. It divides the money into three parts based on different percentages. So, it has three compartments:

50 percent means Needs

50 percent is the biggest chunk of your salary which needs to be spent wisely. These are allocated towards needs which includes all the necessary expenses which are due every month. It will have utility bills, subscription renewals and other expenses for food and repairs around the house included.

One should also be careful of what they are classifying as needs. These are food, water, shelter, and other things like repair of the car. If someone is looking to buy a house or a new car, they would have allocated a percentage of this chunk to their idea. This is what the needs percentage will come in handy for. The leftovers can go into savings. It will also help make lifestyle changes if the costs are going beyond what the limit permits.

20 percent means Savings

The 20 percent chunk is meant to be kept in your savings account. Iit is not to be spent if one can help it. It is supposed to add to your savings which would help in the long run. The savings can be kept anywhere. One can invest in mutual funds, create a life insurance policy, or put them in an emergency fund so that they stay away from dangerous spending habits.

Your financial goals are directly related to how the savings are used. Any earning individual should have at least three months’ worth of savings stored away in case of emergencies when the source of income becomes unreliable. The retirement plans would have to be sorted after three months of savings.

30 percent means Wants

The remaining 30 percent are your free reign. There is an inherent want to spend the money you have earned on something and everything you like and would want to have. It can include clothes, video games, and everything you have been looking to splurge on. Although, it would be better to only spend within this range and not go overboard.

We have already classified that if someone wants to buy a new house or a new car, they would have to keep some money from the 50 percent chunk.However, if you are upgrading, one would have to look into their Wants budget. Simply put, one would have to save their money if they want an Audi instead of a Honda. Any purchase which is more for luxury than economy would be cut from this chunk.

What is the Importance of the 50/20/30 Saving Rule?

The importance of this budgeting rule is to help allocate funds to different aspects of an individual’s life to make management of their finances easier. This helps in creating a healthy budgeting attitude which would help them meet their needs. It would also reduce the debt a person can be in.

For instance, the credit card debt can be paid from the Wants and Needs compartments based on where one spent thor money. It would create a responsible environment where people only spend on what they can pay for. People often let go of their retirement plans in the haste of getting rid of the debt they are in.

The 50/20/30 rule works specifically to initially divide the salary for every kind of expenditure. It would bifurcate the needs and wants which would in turn help in adjusting expectations. If an individual knows how much they can spend, they would be less likely to cross sany thresholds.

There are many services that help in better budgeting. One should know how to make the most of their salary each month. With a personalized Bright Plan, you can set your own goals and manage your finances without the need for complicated calculations. Bright analyzes your spending habits and your income, and then automatically moves funds to a Bright Savings Account based on what you can afford throughout the month. It’s an easy way to reach your financial goals.

The financial goals are also directly related to management of monetary expenses in case of emergencies. One would want to have enough money to fall back upon incase of a medical emergency. This would only be possible if there are enough bucks saved in the bank. One would regret the new splurge if it means compromising on something important.

Additionally, this budgeting rule gives the individual a sense of autonomy because they can manage their own salary. Dividing the money at hand is not difficult if one has a calculator. It then becomes even easier by listing all the necessary expenses. One can also create a bucket list for the things they want.

The Takeaway

It is very easy to look into different budgeting rules but choose only the one which looks the most promising. This is helpful in management of the finances from the start and leaves less room for error. Careful spending can help you in reaching financial goals faster.