People usually associate Europe and Mediterranean countries with wealth and aristocracy. This is the main reason why everyone thinks that living in Europe is expensive and unaffordable. Most Mediterranean countries do impose exorbitant taxes on properties and lands. There are only a few countries that are lenient and do not charge a fortune. Tax is different for every European country and the amount varies largely from one place to the other.

Imposing some fee on properties, lands, building, and houses are a good way to collect revenue. This is because there is very little chance of being able to avoid paying taxes as hiding assets like properties are extremely difficult. Rules and regulations for the payment and collection of revenue are different across all Mediterranean countries. You can look up for more details on real estate business in Italy on Accountingbolla.com.

In this article we will give you an overview of the property tax systems in Mediterranean countries.

Portugal

Portugal is an ideal place to stay. It is beautiful, inhabited by friendly people, and has incredible cuisine and unforgettable culture. Therefore, it is the perfect holiday destination, and buying a building in Portugal is a dream for many of us.

Imposto Municipal Sobre Transmissôes Onerosas de Imóveis (IMT) is the main fee levied on Portuguese properties. The rate varies for different houses. For example, a lavish cottage will cost you a little more than an ordinary apartment. Moreover, stamp duty is levied on the properties as well at the time of purchase. This is known as the Imposto de Selo.

Non-residents have to pay some fee if they are living in a rented apartment or house. As a non-resident, you can take advantage of the many lucrative offers that the Portuguese government has for foreigners. Make sure you read all the rules and guidelines carefully.

Capital gains are another kind of fee that is imposed at the time of selling a property. If you are a resident you may be able to avoid paying this revenue. Non-residents need to pay 28% capital gains if they wish to sell a property in Europe. The revenue system in Portugal is quite advanced and the system is well-organized. It should not take you much time to get a hang of important rules and regulations of the country.

Spain

This unique country is an amalgamation of culture and beliefs. Spanish people will always greet you with a smile. The quality of food available in the country is unparalleled and their recipes will blow your mind. Apart from that the dance, music, and aesthetics of the country will enrich your experience.

When it comes to property tax, Spanish people are extremely serious. They do not like carelessness. Therefore, before buying land, property, or structures in Spain make sure you do adequate research and have some knowledge about their rules and regulations. Stamp duty is one of the main taxes that you will face in the country. The fee is levied on new properties within the country. IVA is the Spanish VAT that is charged on commercial construction and lands.

If you wish to buy or from foreigners (non-residents) three percent of the total cost of the property has to be paid to the government and revenue authorities. After you have purchased the property in Spain there are several other taxes like Impuesto Sobre Bienes Inmuebles – IBI) and Impuesto Sobre Patrimonio that you will have to pay as well.

Italy

Italy has become a business hub as well as a place of tourist attraction. The country does an excellent job of handling both the politics and economy of the country. Visitors often describe Italy as unforgettable and exciting.

We will now talk about the different taxes that you have to pay while purchasing a home in Italy. The stamp duty is one of the primary taxes in the country and has to be paid by all when buying a new house. The percentage that has to be paid mainly depends on whom you are purchasing the property. If you wish to transact with a private owner you can avoid the VAT

There are other kinds of fees that are levied at the time of buying land and buildings. Land registry is one of these. This is mainly paid when the owner of the property changes or during the registration of the building. The tax has to be paid by the new owners of the structure. You will also come across the terms mortgage and capital gain tax when purchasing land of structure in Italy. These are the different kinds of taxes that you have to pay if you dream of living in this extraordinary country.

Greece

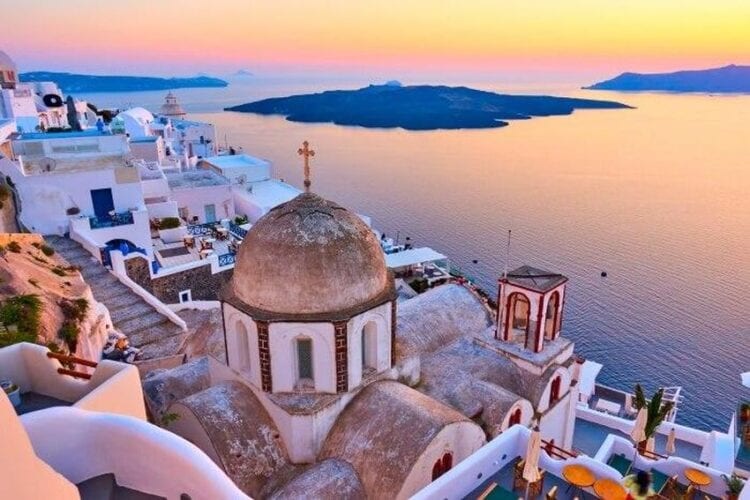

Greece is a beautiful country with rich heritage and culture. The different structures present in Athens, Santorini, and Mykonos are worth the visit. If you want to enjoy the deep blue waters of the Mediterranean along with exquisite food, we recommend you to purchase a property in Greece and enjoy all that the country has to offer.

After the difficulties faced by all the European countries in the year 2007, the real estate industry has suffered greatly. However, Greece allows you to purchase and own Greek property even if you are a foreigner. Consult with a lawyer who knows Greek laws before signing any paper or buying a property. As a non-resident, you must have a number for tax registration as this will help you to understand the regulations and systems of the country. Acquisition cost, legal fees, and property fees are some of the other fees that the Greek government imposes while buying a new building or land.

Conclusion

European countries are not exactly cheap. prepare yourself to pay different kinds of fees before buying a house in any Mediterranean country. However, the beauty of all these places is worth all the charges. Understand all the rules as they vary across different states. violating any major law will invite a lot of unnecessary penalties. The rules are also different for residents and non-residents in most places. If it all gets a little too confusing for you do not hesitate to contact a lawyer.